Summary:

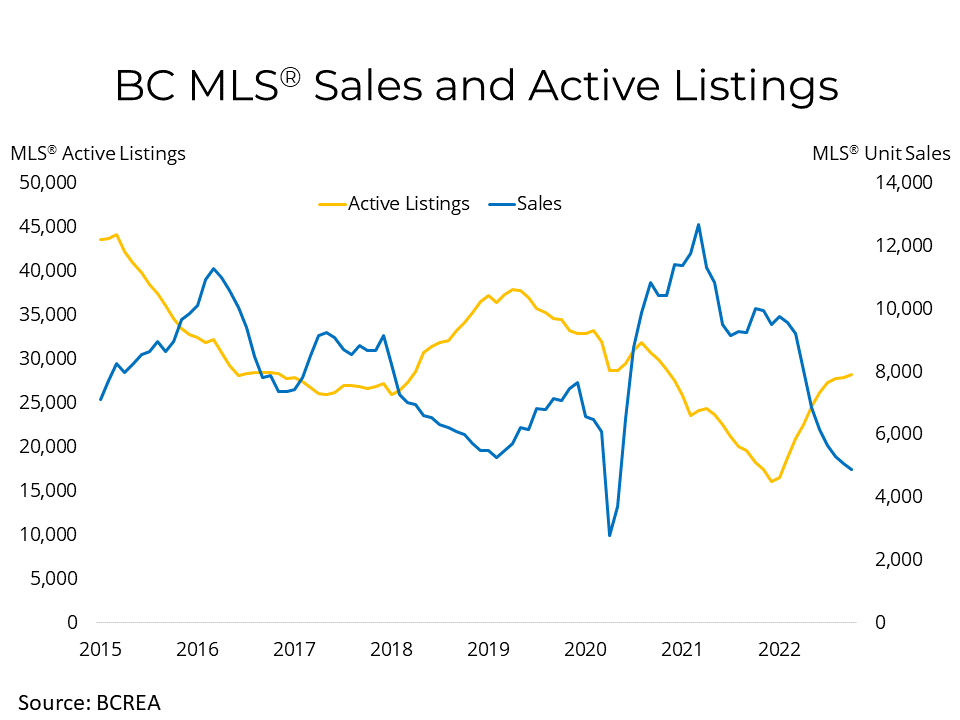

- Both residential unit sales and average price were decreased from the same time last year.

- Home sales have risen for three consecutive months and yet matched by new listings coming onto the market, which causes the price to rise.

Vancouver, BC – May 11, 2023.

The British Columbia Real Estate Association (BCREA) reports that a total of 7,427 residential unit sales were recorded in Multiple Listing Service® (MLS®) systems in April 2023, a decrease of 17.7 per cent from April 2022. The average MLS® residential price in BC was 995,506 down 5.6 per cent compared to the average price of close to $1.1 million in April 2022. The total sales dollar volume was $7.4 billion, representing a 22.5 per cent decrease from the same time last year.