Highlights

- Bond yield volatility surges through the Fall.

- The Canadian economy may be starting its descent into a recession.

- A Bank of Canada pivot in 2023?

Mortgage Rate Outlook

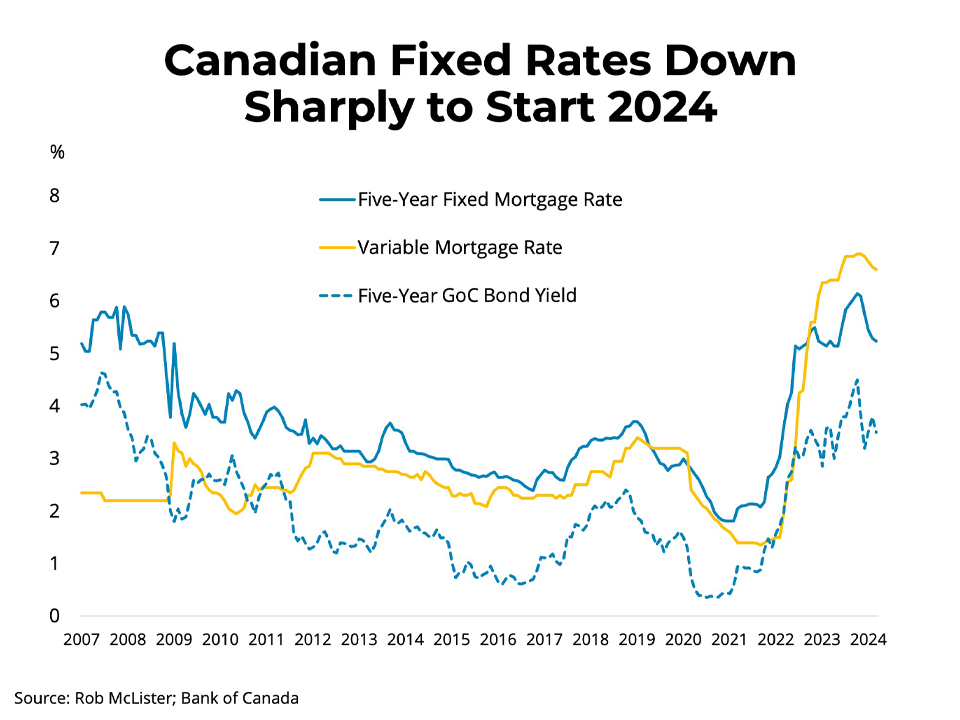

The relative calm in the mortgage markets contrasts with the unprecedented volatility in the bond market. From just the second half of October to early November, Canadian bond yields experienced three of the top 25 most significant daily moves over the past 20 years. Indeed, the bond market seems to be evaluating and re-evaluating the Bank of Canada’s overnight rate path with each data release and announcement. Interestingly, even with the still persistently high Canadian inflation in October, bond yields have fallen and are now at levels last seen in early October.

Despite the decline in bond yields from where they peaked in early October, we have not seen an adjustment to five-year fixed rates as lenders wait for a clear signal on the direction of their funding costs. If five-year bond yields sustain the most recent decline, we may see five-year fixed mortgage rates head lower, even in the face of a still-tightening Bank of Canada. The same scenario played out in 2019 when the Bank was near the end of its tightening cycle and economic growth began to stall.

We expect that the average Canadian variable mortgage rate will rise to 6.35 per cent, consistent with a 4.5 per cent Bank of Canada overnight rate. Our forecast is for the Bank of Canada to begin lowering its policy rate next year, which will be passed through to variable rates by the end of 2023.

Five-year fixed rates have likely peaked at their current average of 5.5 per cent. Assuming the recent decline in Canadian bond yields is sustained, or even that yields fall further on an increasingly pessimistic outlook, fixed mortgage rates should begin falling in early 2023, ultimately ending the year around 5 per cent.

Economic Outlook

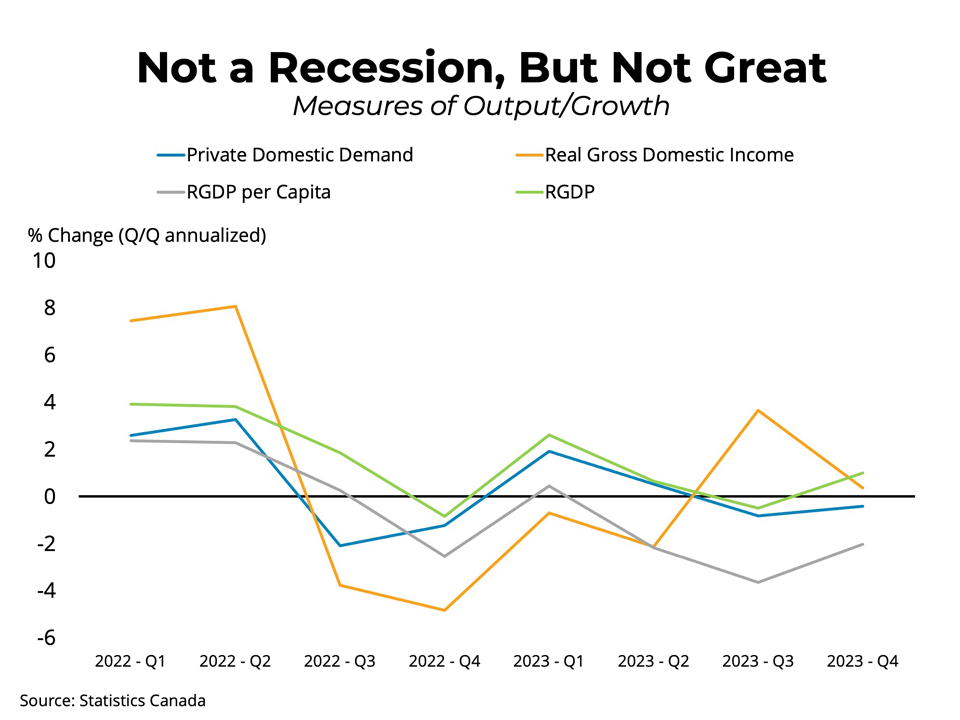

Growth in the third quarter of 2022 registered 2.9 per cent at an annualized rate from the prior quarter, rising for the fifth consecutive quarter. However, the details of third-quarter GDP growth were much weaker than the headline and may point to a more significant economic slowdown. Growth in Final Sales to Private Domestic Purchasers, a less volatile measure of growth which includes two components of GDP - Household Consumption and Private Investment (Residential and Non-Residential) was negative in the third quarter, pulled down by declining household spending and residential investment.

It is rare, outside of recessions or pandemic lockdowns, to see household spending fall quarter-over-quarter, and while one quarter does not make a trend, it is something to monitor as recession fears rise. We expect to see a sustained slowing of the economy as the Bank continues its tightening cycle, particularly in interest rate-sensitive sectors like housing. There is an elevated risk that GDP may contract in 2023 as rate increases start to impact the broader economy. This scenario is already being priced into the Canadian yield curve, which is now more deeply inverted than at any time since the month prior to the 1990 recession.

Bank of Canada Outlook

After raising its overnight rate by 400 basis points this year, the Bank of Canada appears to be close to the end of this tightening cycle. Given that the overnight rate is projected to rise to more than 100 basis points higher than the top end of the Bank’s estimate of neutral (2-3 per cent), the question that remains is how long interest rates will remain at that elevated level.

Simulations from our macroeconomic model suggest the Bank may reverse course in the second half of 2023 as the Bank responds to a significant slowdown in the Canadian economy or even a brief recession. That perspective is in line with current financial market expectations showing a similar timing for the Bank to reverse course. Crucially, any loosening of monetary policy will only occur if we see a sustained decline in inflation. Given weakening economic growth, falling gasoline and other commodity prices, and fading effects from pandemic driven supply chain problems, we could see a significant downward trajectory for inflation in 2023, which would provide the Bank with the necessary support to begin lowering its policy rate.

Comments:

Post Your Comment: