Housing Market Activity Remains Slow in November

|

|

|

Real Estate Consultant, CIPS®, SRES®, MCNE®

Personal Real Estate Corporation

KELLER WILLIAMS Realty VanCentral 英語,普通話,粵語

|

|

|

Highlights

Mortgage Rate Outlook

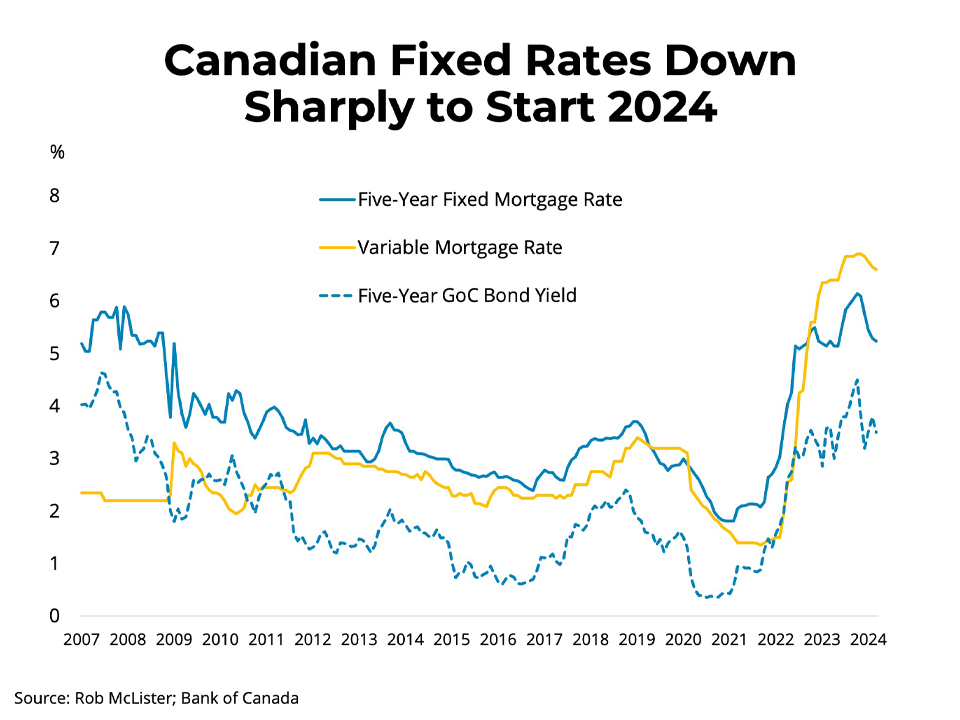

The relative calm in the mortgage markets contrasts with the unprecedented volatility in the bond market. From just the second half of October to early November, Canadian bond yields experienced three of the top 25 most significant daily moves over the past 20 years. Indeed, the bond market seems to be evaluating and re-evaluating the Bank of Canada’s overnight rate path with each data release and announcement. Interestingly, even with the still persistently high Canadian inflation in October, bond yields have fallen and are now at levels last seen in early October.

Despite the decline in bond yields from where they peaked in early October, we have not seen an adjustment to five-year fixed rates as lenders wait for a clear signal on the direction of their funding costs. If five-year bond yields...

SURREY, BC – With sales down almost seven per cent from October, and new listings off by more than 20 per cent, the Fraser Valley housing market continues its slowing trend heading into the holiday season. Despite the market slowdown, opportunities are available, as evidenced by brisk turnover time frames.

In November, the Fraser Valley Real Estate Board (FVREB) processed 839 sales on its Multiple Listing Service® (MLS®), a 6.9 per cent decrease compared to October and a decrease of 57.5 per cent compared to November 2021.

“The trends we’ve seen over the past several months will likely continue through to year-end,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “While rate hikes have effectively put many buyers and sellers in a holding pattern, we’re still seeing relatively quick turnover for all housing categories, indicating robust opportunities for properties that are strategically priced.”

The Board received 1,703...

While typically a quiet month of market activity based on seasonal patterns, November home sale and listing totals lagged below the region’s long-term averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,614 in November 2022, a 52.9 per cent decrease from the 3,428 sales recorded in November 2021, and a 15.2 per cent decrease from the 1,903 homes sold in October 2022.

Last month’s sales were 36.9 per cent below the 10-year November sales average.

“With the most recent core inflation metrics showing a stubborn reluctance to respond significantly to the furious pace of rate increases, the Bank of Canada may choose to act more forcefully to bring inflation back toward target levels.” Andrew Lis, REBGV’s director, economics and data analytics said. “While it’s always difficult to predict what the bank will do with certainty, this persistent inflationary backdrop sets up the December...

傅浩桓, Frank Fu

Personal Real Estate Corporation

Cell 778-388-6839

3995 Fraser Street

Vancouver, BC

V5V 4E5